California inflation relief checks: New dates announced for debit card payments

Where's my inflation relief money?

As many as 23 million Californians are eligible to receive inflation relief payments of up to $1,050, with the first batch of payments disbursed Oct. 7.

LOS ANGELES - If you haven't already received your California inflation relief payment, it looks like you may have to wait a little bit longer than previously anticipated.

The California Franchise Tax Board announced new dates for those who have yet to receive the Middle Class Tax Refund.

SUGGESTED:

- Where is my California inflation relief check?

- California inflation relief payments: Here's when you'll get the money

- California inflation checks: How will I get paid?

- California inflation relief refund: Here's who's eligible for payment

- Millions of Californians could get $1,050 'inflation relief' checks from government: Do you qualify?

As many as 23 million Californians are eligible to receive inflation relief payments of up to $1,050, with the first batch of payments disbursed Oct. 7.

Here is the updated timeline from the Franchise Tax Board:

Direct deposit payments

GSS I or II direct deposit recipients

When: 10/07/2022 through 10/25/2022

Non-GSS recipients

When: 10/28/2022 through 11/14/2022

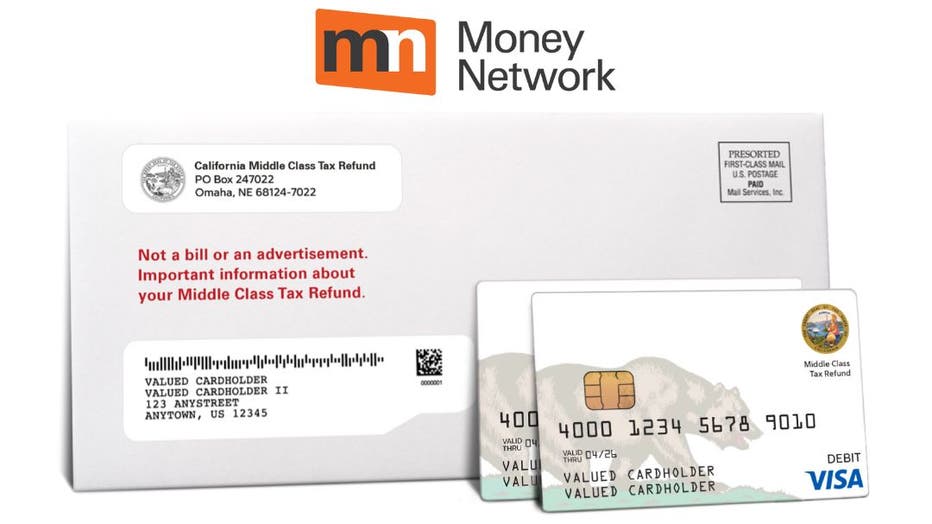

Photo courtesy Franchise Tax Board

Debit card payments

GSS I or II check recipients (last name beginning with A – E)

When: 10/24/2022 through 11/05/2022

GSS I or II check recipients (last name beginning with F – M)

When: 11/06/2022 through 11/19/2022

GSS I or II check recipients (last name beginning with N – V)

When: 11/20/2022 through 12/03/2022

GSS I or II check recipients (last name beginning with W – Z)

When: 12/04/2022 through 12/10/2022

Non-GSS recipients (last name beginning with A – L)

When: Will be announced after 11/07/2022

Non-GSS recipients (last name beginning with M – Z)

When: Will be announced after 11/21/2022

Direct deposit recipients who have changed their banking information since filing their 2020 tax return

When: 12/17/2022 through 01/14/2023

Californians are reminded that direct deposits typically occur within 3-5 business days from the issue date, but may vary by bank.

Allow up to 2 weeks from the issue date to receive your debit card by mail.

The FTB expects about 90% of direct deposits to be issued in October, with about 95% of all MCTR payments — direct deposit and debit cards combined — to be issued by the end of this year.

Payment amounts vary on income and 2020 taxes. Below is a breakdown of the expected payments, according to the Franchise Tax Board.

Joint returns

- AGI of $150,000 or less: $1,050 with dependent or $700 without

- AGI $150,001 to $250,000: $750 with dependent or $500 without.

- AGI of $250,001 to $500,000: $600 with dependent or $400 without.

Head of Household

- AGI of $150,000 or less: $700 with dependent or $350 without.

- AGI of $150,001 to $250,000: $500 with dependent or $250 without.

- AGI of $250,001 to $500,000: $400 with dependent or $200 without.

Those who file single

- AGI of $75,000 or less: $700 with dependent or $350 without.

- AGI of $75,001 to $125,000: $500 with dependent or $250 without.

- AGI of $125,001 to $250,000: $400 with dependent or $200 without

Single filers making more than $250,000 and joint filers making more than $500,000 are not eligible for payments.