Most Americans cannot afford a $1K emergency expense

Most U.S. adults say they can not afford to pay a $1,000 emergency expense from their savings. (Photo by Justin Sullivan/Getty Images)

A majority of Americans say a $1,000 emergency expense would be too great of a hit to their savings and that they could not afford it, according to new data released Wednesday.

Bankrate's latest survey results found 56% of U.S. adults lack the emergency funds to handle a $1,000 unexpected expense and one-third (35%) said they would have to borrow the money somehow to pay for it.

Most U.S. adults say they can not afford to pay a $1,000 emergency expense from their savings. (Photo by William DeShazer for The Washington Post via Getty Images)

Of those, 21% said they would likely put such an expense on a credit card, while 10% said they would borrow the funds from a family member or friend, and 4% said they would take out a personal loan. Sixteen percent said they would reduce their spending in other areas to cover the bill.

"All too many Americans are playing with fire when it comes to their personal finances in the sense that they don’t have more in emergency savings," said Bankrate senior economic analyst Mark Hamrich. "Inflation has been a key culprit standing in the way of further progress on the savings front."

MAJORITY OF AMERICANS FEEL US ECONOMY IS IN RECESSION: SURVEY

Perhaps unsurprisingly, the older the respondent was, the more likely they were to say they could pay for a $1,000 expense from their savings.

Fifty-nine percent of baby boomers (ages 60-78) said they could handle a $1,000 expense, followed by 43% of millennials (ages 28-43), 36% of Gen Xers (ages 44-59) and 31% of Gen Zers (ages 18-27.)

Customers shop at a grocery store in the Brooklyn borough of New York on Dec. 13, 2022. Inflation has risen more than 17% since January 2021. (Michael Nagle/Xinhua via Getty Images / Getty Images)

"On the one hand, it is remarkable that more individuals and households do not have more funds at their disposal to respond to unexpected expenses," Hamrich said. "Historically high inflation has certainly taxed household budgets in recent years, but we are seeing improvement in this department with real wages on the rise."

CREDIT CARD DELINQUENCIES SURGE AS AMERICANS BATTLE HIGH INFLATION, INTEREST RATES

Inflation has cooled considerably from a peak of 9.1% notched during June 2022 to 3.4% year-over-year in December. Yet, when compared with January 2021, shortly before the inflation crisis began, prices are up a stunning 17.6%.

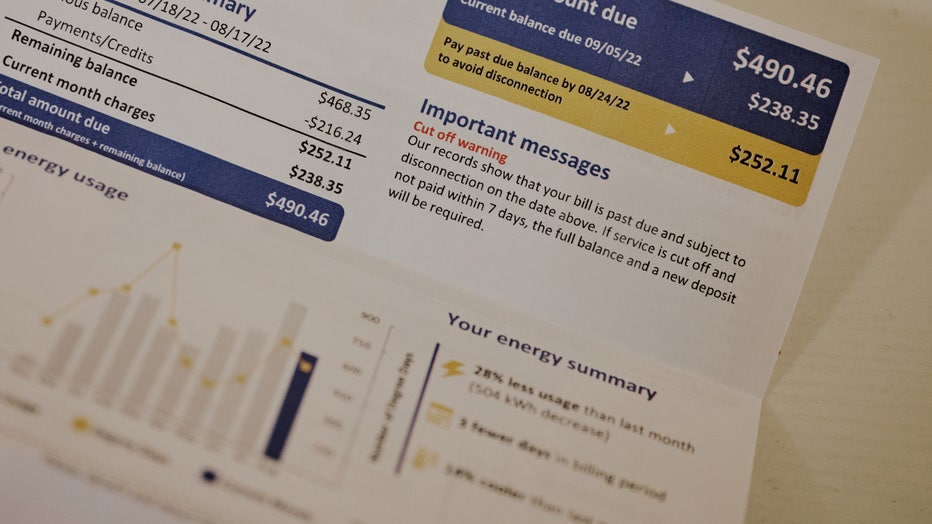

The sharp price increases have squeezed U.S. household budgets and led to Americans putting more everyday expenses on credit cards. Although the Federal Reserve's aggressive rate hike campaign has caused inflation to ease, credit card balances are accelerating as the average annual percentage rate hit a new record of 20.72%, according to Bankrate data from earlier this month.

The average credit card interest rate hit a record 20.72% earlier this month. (Robert Nickelsberg/Getty Images / Getty Images)

"The good news is that inflation is receding and the highest yields, in terms of returns on savings, remain the most favorable we’ve seen in many years," Hamrich said.

"There’s no better time than the present to prioritize emergency savings," he added. "Otherwise, potentially costly borrowing rates will come into play, particularly with the average for credit rate interest rates close to 21%. That’s the other, expensive side of the proverbial high interest rate environment coin."

FOX Business' Megan Henney contributed to this report.

LINK: Get updates and more on this story at foxbusiness.com.